Why Consumer Sales are the Best Kept Secret for Aftermarket E-Commerce

February 14, 2017

Why Consumer Sales are the Best Kept Secret for Aftermarket E-Commerce

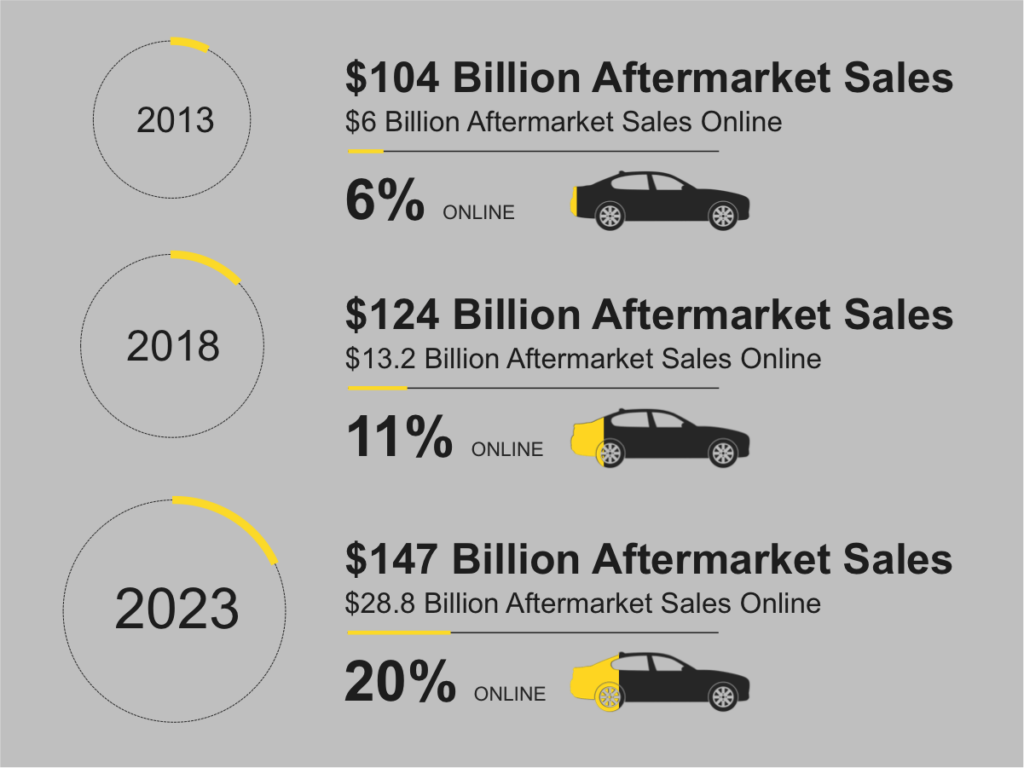

Digital technologies are reshaping buyer expectations and putting pressure on aftermarket companies to adapt. Some experts predict that online sales will double by 2018, while sluggish brick-and-mortor sales fall flat.

To navigate the e-commerce landscape, aftermarket companies need to tap into emerging markets and shift investments to establish comprehensive web presence.

As almost all growth will come from online sales, aftermarket companies cannot afford to ignore these new distribution models.

Take a look at these projections from the Autocare Association:

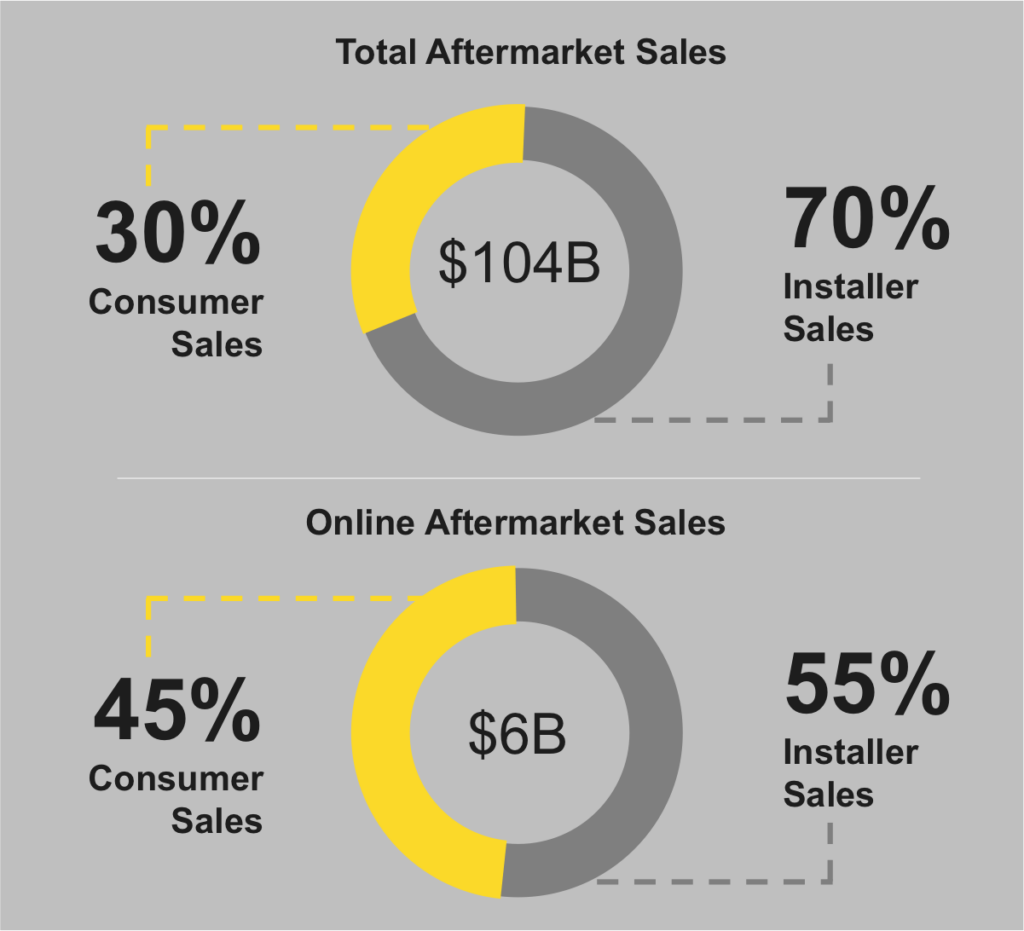

Automotive replacement sales are comprised of two categories: installer sales and consumer sales. Installers have traditionally dominated total sales, but consumers’ digital preference indicates a large opportunity for growth.

Almost 9% of consumers purchase replacement parts online. By comparison, 10% of consumer footwear sales and 1% of consumer packaged goods sales are online.

While footwear has long established an engaged and competitive digital presence, automotive aftermarket companies have extensive opportunity to win sales and loyalty by developing digital capabilities that meet emerging consumer expectations and preferences.

DEFINING THE AUTOMOTIVE CONSUMER

No longer is the replacement parts market overrun with older men. The flexibility and convenience of online shopping has created a new group of consumers, diverse in age, gender, and income.

According to a recent report by UPS, What’s Driving the Automotive Parts Online Shopper, 40% of online shoppers are women. For smart marketers, this group represents a highly uncharted opportunity for future growth.

Tip: Women who purchase online are almost twice as likely than their male counterparts to have automotive parts installed for them—21% compared to 10% of males.

The same report also states that 28% of online aftermarket online shoppers are millennials aged 18 to 34. This group, which becomes increasingly dominant each day, is tech savvy and sophisticated in their online expectations.

As millennials begin to saturate the market, so too will their use of mobile devices. Currently, almost half of millennials use their phones or tablets to make an automotive purchase online, while only 17% of other age groups go mobile.

Tip: Millennials are fluent in social media. 90% of millennial respondents said they use social media sites to guide an aftermarket purchase and 66% said they would turn to social media to express dissatisfaction about a purchase.

TAP INTO DIGITAL PREFERENCES

As the online channel continues to grow, so do the expectations of aftermarket consumers. Brand name takes a backseat to consumer expectations, leveling the playing field for those looking to get ahead.

UPS reports that 35% of all aftermarket consumers are power shoppers who make more than 9 online purchases in a typical 3-month period. These frequent buyers value the convenience and flexibility of online shopping, and will be loyal to companies providing a high quality web experience throughout the purchase path.

Comprehensive information is the currency of user experience. Ease of navigation, detailed imagery, and website functionality is now the cost of doing business.

Digital technologies will continue to reshape consumer demand. As older generations age out of the market, evolving preferences of the millennial age group become increasingly crucial for future success. Aftermarket companies that tap into this digitally driven demand will create enormous value for online consumers. Those who don’t will be left behind in a slow-growth offline world.