1WorldSync recently published The 2023 Consumer Product Content Benchmark Report, based on a survey of 1,500 US and Canada-based consumers about the latest shopping trends. The report covers topics including pre-shopping research, the power of influencers, the reality of reviews and more.

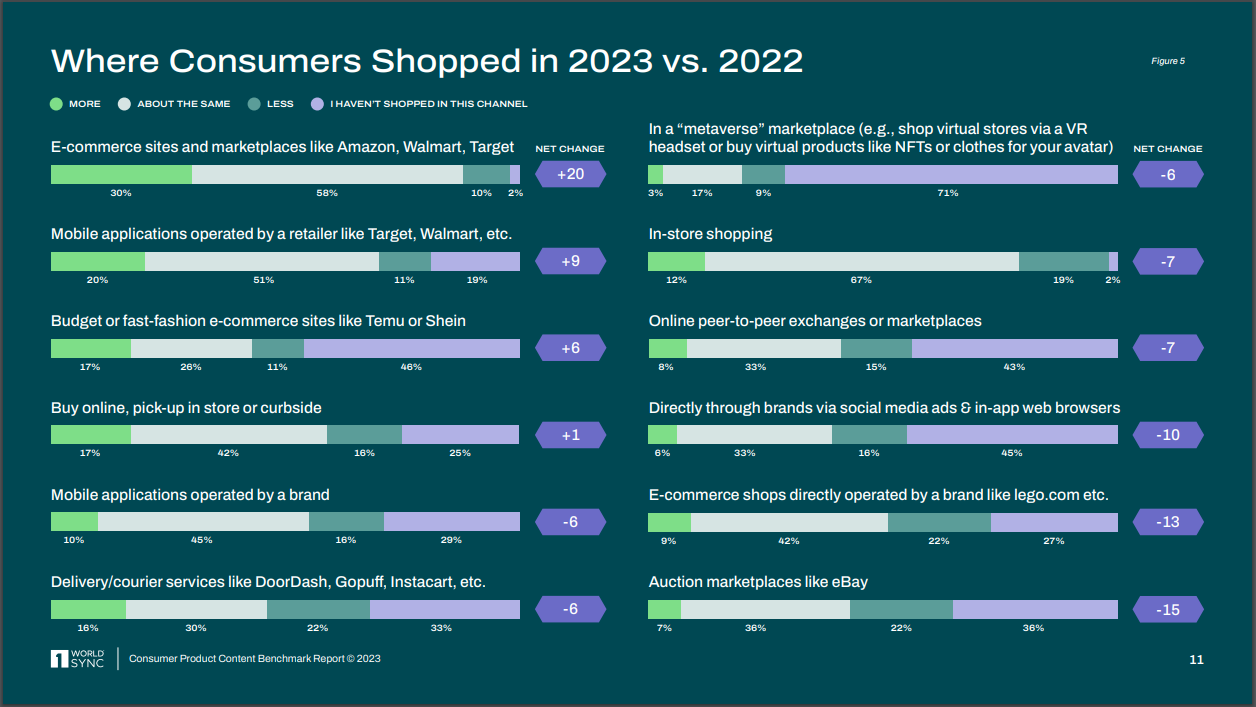

In this blog, we will break down a specific data set from the report: where consumers are shopping. We’ll cover which shopping channels are growing, which are losing traction and why.

Read on to learn more about the most trafficked shopping channels or read the full report here.

Dominance of Major E-commerce Retailers

One of the most striking findings from the report is the continued dominance of major e-commerce retailers and marketplaces. These platforms are not just maintaining their customer base; they’re expanding it. The data reveals that almost all shoppers use these channels, with a significant 20 percentage point net increase in usage compared to the previous year. This surge underscores the importance of a strong online presence for retailers.

Mobile Apps and Brick-and-Mortar Synergy

Another key trend shown in the data is the growing significance of retailer-owned mobile apps. These apps are not only enhancing online sales but also playing a crucial role in driving foot traffic to physical stores. For retailers with large brick-and-mortar footprints, the synergy between digital and physical channels is becoming increasingly important. It’s a clear indicator that integrating online and offline experiences is a powerful strategy for retail success.

Shifts in Product Category Preferences

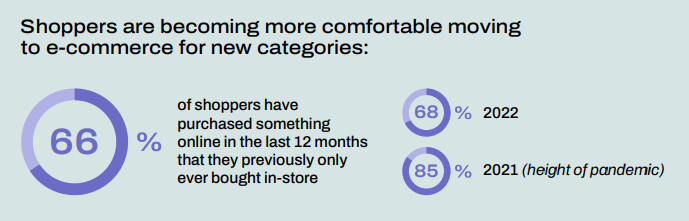

The report also sheds light on changing consumer preferences in product categories. Similar to the previous year, there’s a notable shift from in-store to online shopping in specific categories:

50% of consumers shopped online for select clothing and accessories.

42% shifted to purchasing health or personal care items online.

35% moved to online shopping for beauty and cosmetics products.

This shift signifies a growing comfort with purchasing a diverse range of products online, beyond traditional e-commerce staples.

Decline in Other Shopping Channels

Interestingly, some shopping channels are losing momentum. There’s a 23% decrease in shoppers using delivery services or courier apps compared to the previous year. This decline could be attributed to a variety of factors including changes in consumer habits post-pandemic or increased preference for direct shopping experiences.

The DTC Downtrend

Direct-to-consumer (DTC) channels, which include brand-owned e-commerce sites and social advertising, are also experiencing a downturn. This trend is particularly noticeable among younger consumers, who are increasingly gravitating towards fast-fashion e-commerce sites like Temu and Shein. This shift suggests a change in brand loyalty and shopping preferences, emphasizing the need for brands to adapt their strategies to stay relevant.

Implications for Retailers and Brands

These trends have significant implications for retailers and brands:

Embrace Omnichannel Strategies: The data underscores the importance of a cohesive omnichannel strategy that seamlessly integrates online and offline experiences.

Focus on Mobile and Digital Presence: Investing in mobile apps and a robust online presence is more crucial than ever, given the clear consumer preference for shopping through these channels.

Adapt to Changing Category Preferences: Brands must stay attuned to shifts in category preferences and be ready to meet consumers where they are – increasingly, online.

Reevaluate DTC Approaches: With the decline in DTC channels, brands should reassess their strategies and consider how they can engage with consumers on the platforms they prefer.

Understand Young Consumer Behavior: The shift towards fast-fashion e-commerce sites by younger consumers highlights the need for brands to understand and adapt to the preferences of this demographic.

The 2023 Product Content Benchmark Report offers critical insights for retailers and brands navigating the evolving retail landscape. By understanding and adapting to these trends, businesses can better position themselves to meet consumer needs and achieve sustained success in the ever-changing world of e-commerce.